how much federal taxes deducted from paycheck nc

This money goes to the IRS where it is counted toward your annual income taxes. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here.

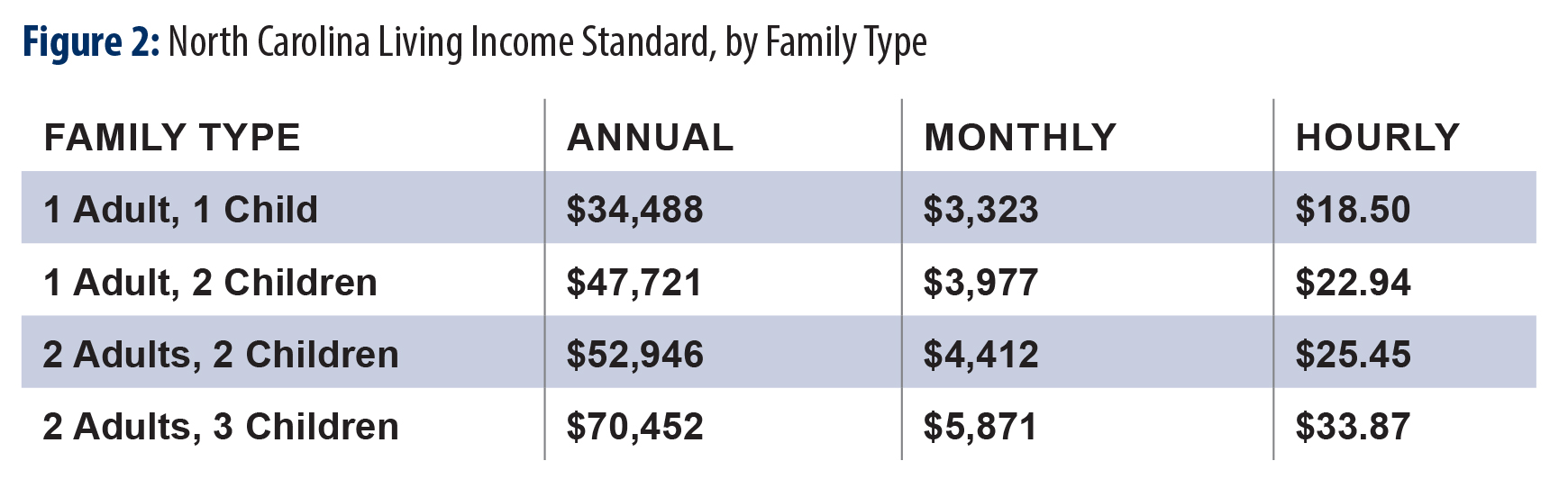

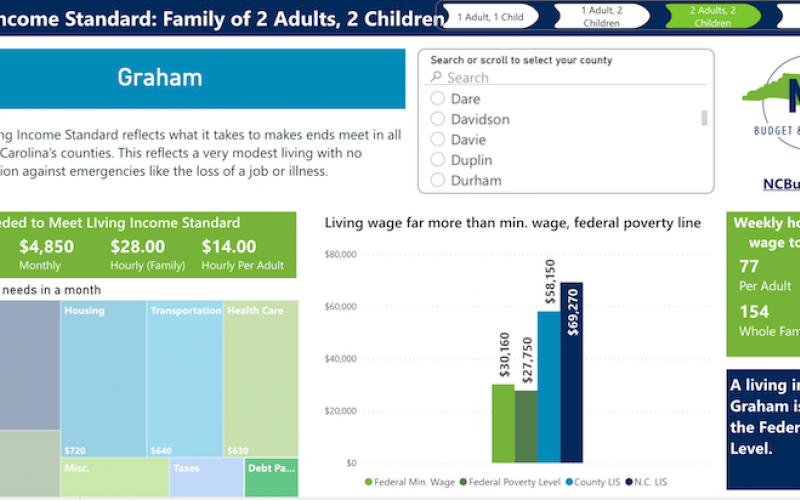

The 2019 Living Income Standard For 100 Counties North Carolina Justice Center

And you must report the entire amount you receive each year on your tax return.

. Subtract and match 62 of each employees taxable wages until they have earned 147000 2022 tax year for that calendar year. The amount of taxes to be withheld is. See how your refund take-home pay or tax due are affected by withholding amount.

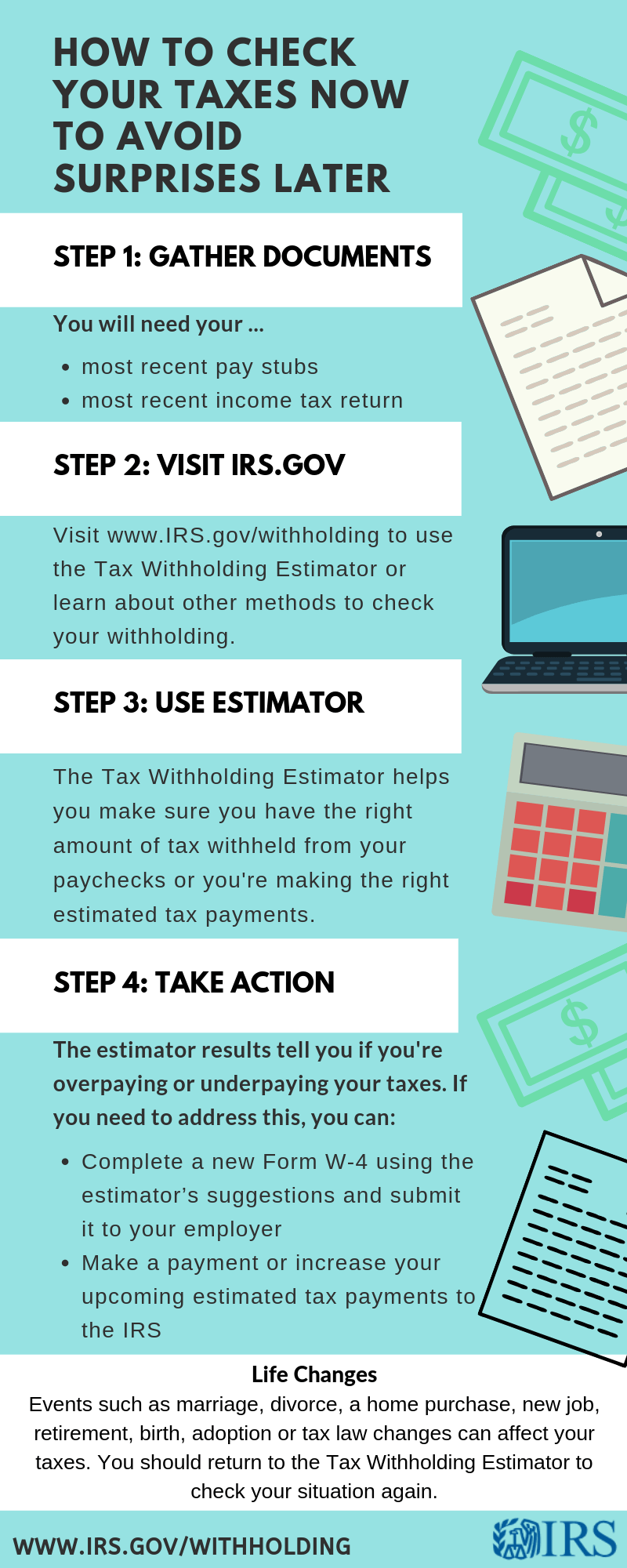

The Calculator will help you identify your tax withholding to make sure you have the right. North Carolina has a flat income tax rate of 525 meaning all taxpayers pay this rate regardless of their taxable income or filing status. For example lets say you elected to.

The 2023 Tax Calculator uses the 2023 Federal Tax Tables and 2023 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Social Security Tax.

North Carolinas flat tax rate for 2018 is 549 percent and standard deductions were 8750 if you filed as single and 17500 if you were married and filing jointly. That means your winnings are taxed the same as your wages or salary. Some states follow the federal tax year some.

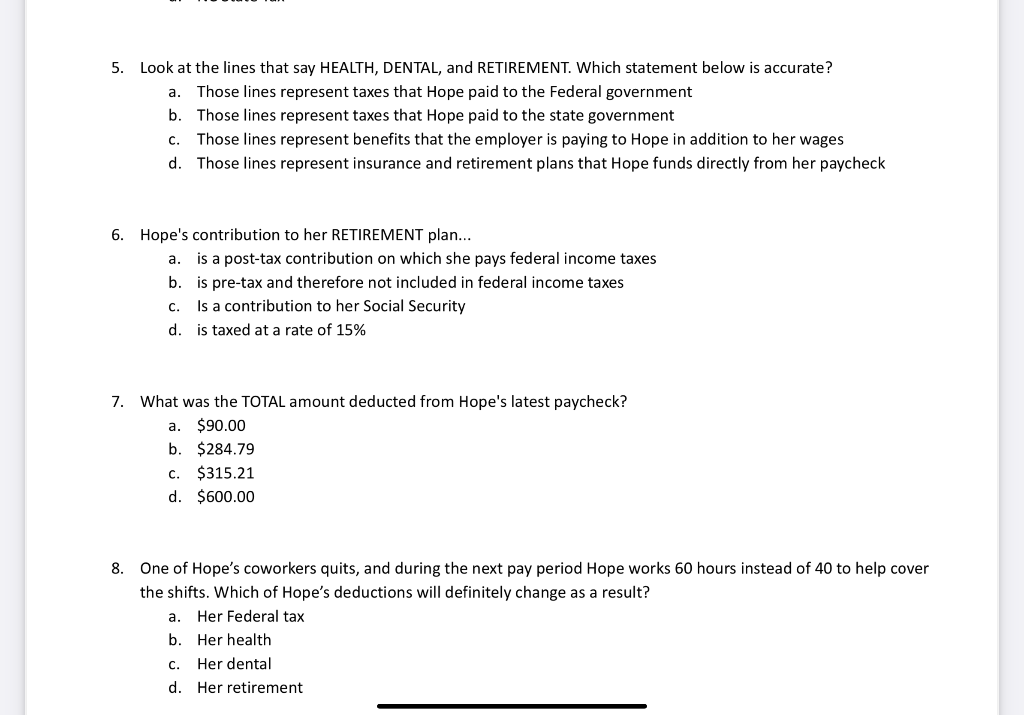

Just enter the wages tax withholdings and other information required. How much tax is deducted from a paycheck in NC. Some deductions from your paycheck are made.

In October 2020 the IRS released the tax brackets for 2021. The state tax year is also 12 months but it differs from state to state. Therefore it will deduct only the state income tax from your paycheck.

Use ADPs North Carolina Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. For 2022 employees will pay 62 in Social Security on the. FICA taxes consist of Social Security and Medicare taxes.

How It Works. Effective January 1 2020 a payer must deduct and withhold North Carolina income tax from the non-wage compensation paid to a payee. It is a flat rate that is unchanged.

The median household income is 52752 2017. Besides FICA taxes you will see federal income taxes are also taken out of your paychecks. In North Carolina The state income tax in North Carolina is 525.

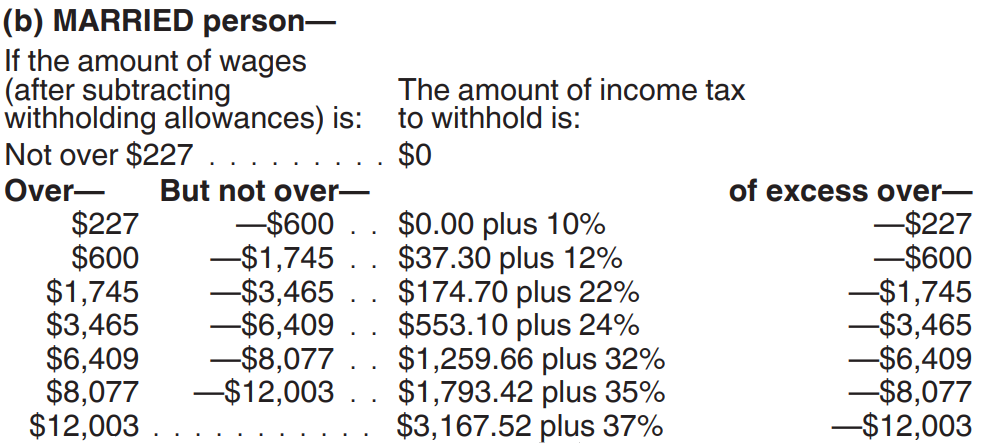

The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. These amounts are paid by both employees and employers. New Federal Tax Withholding Tables were added to the Integrated HR-Payroll System last month.

Hourly non-exempt employees must be paid time and a. How Is Tax Deducted From Salary. The money also grows tax-free so that you only pay income tax when you withdraw it at which point it has hopefully grown substantially.

No state-level payroll tax. Minimum Wage in North Carolina in 2021. Your household income location filing status and number of personal exemptions.

Estimate your federal income tax withholding. Use this tool to. The income tax is a flat rate of 499.

The payer has to deduct an amount of tax based on the rules prescribed by the.

North Carolina Salary Calculator 2022 Icalculator

North Carolina Restaurant Adding 20 Fair Wage Service Fee To Every Bill Wric Abc 8news

New York Hourly Paycheck Calculator Gusto

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

New Tax Law Take Home Pay Calculator For 75 000 Salary

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Explaining Paychecks To Your Employees

Irs Launches New Tax Withholding Estimator North Carolina Association Of Certified Public Accountants

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Solved Earnings Statement Company Name Some Corporation 123 Chegg Com

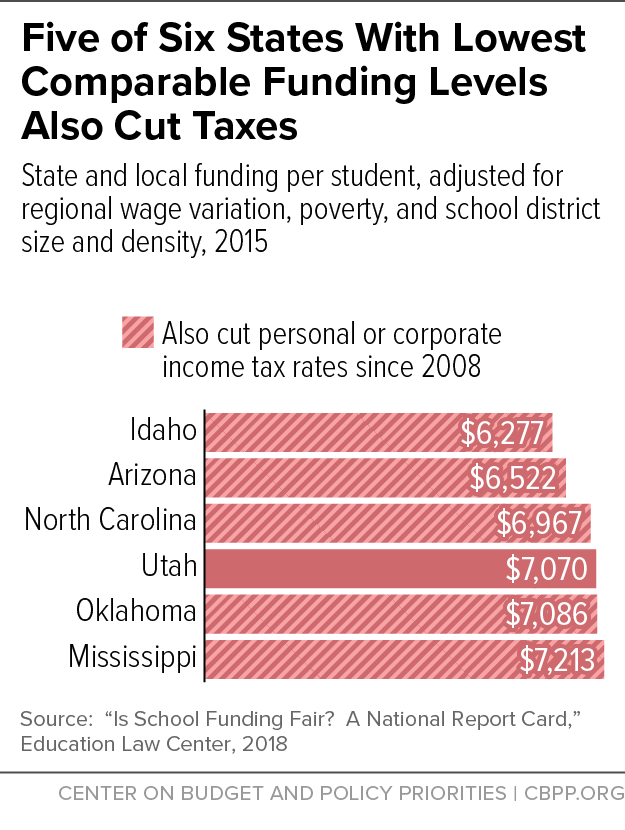

North Carolina S Deep Tax Cuts Impeding Adequate School Funding Center On Budget And Policy Priorities

Earning A Living In Graham County The Graham Star Robbinsville North Carolina

Individual Income Taxes Urban Institute

State Income Tax Rates And Brackets 2021 Tax Foundation

How Much Taxes Deducted From My Paycheck N C

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

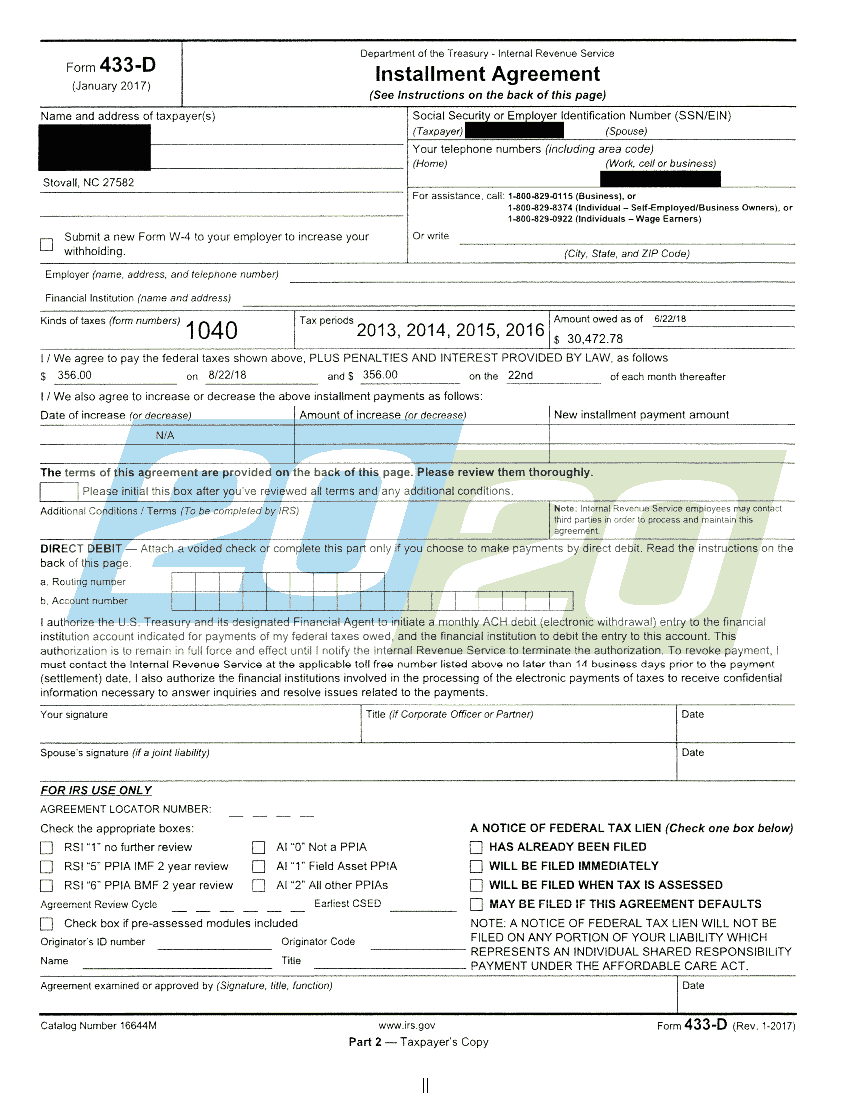

Irs Accepts Installment Agreement In Stovall Nc 20 20 Tax Resolution

How To Calculate Payroll And Income Tax Deductions Peo Human Resources Blog